Fascination About Wealth Management

Wiki Article

A Biased View of Wealth Management

Table of ContentsThe Wealth Management StatementsNot known Details About Wealth Management The Best Strategy To Use For Wealth ManagementThe Facts About Wealth Management RevealedWhat Does Wealth Management Mean?

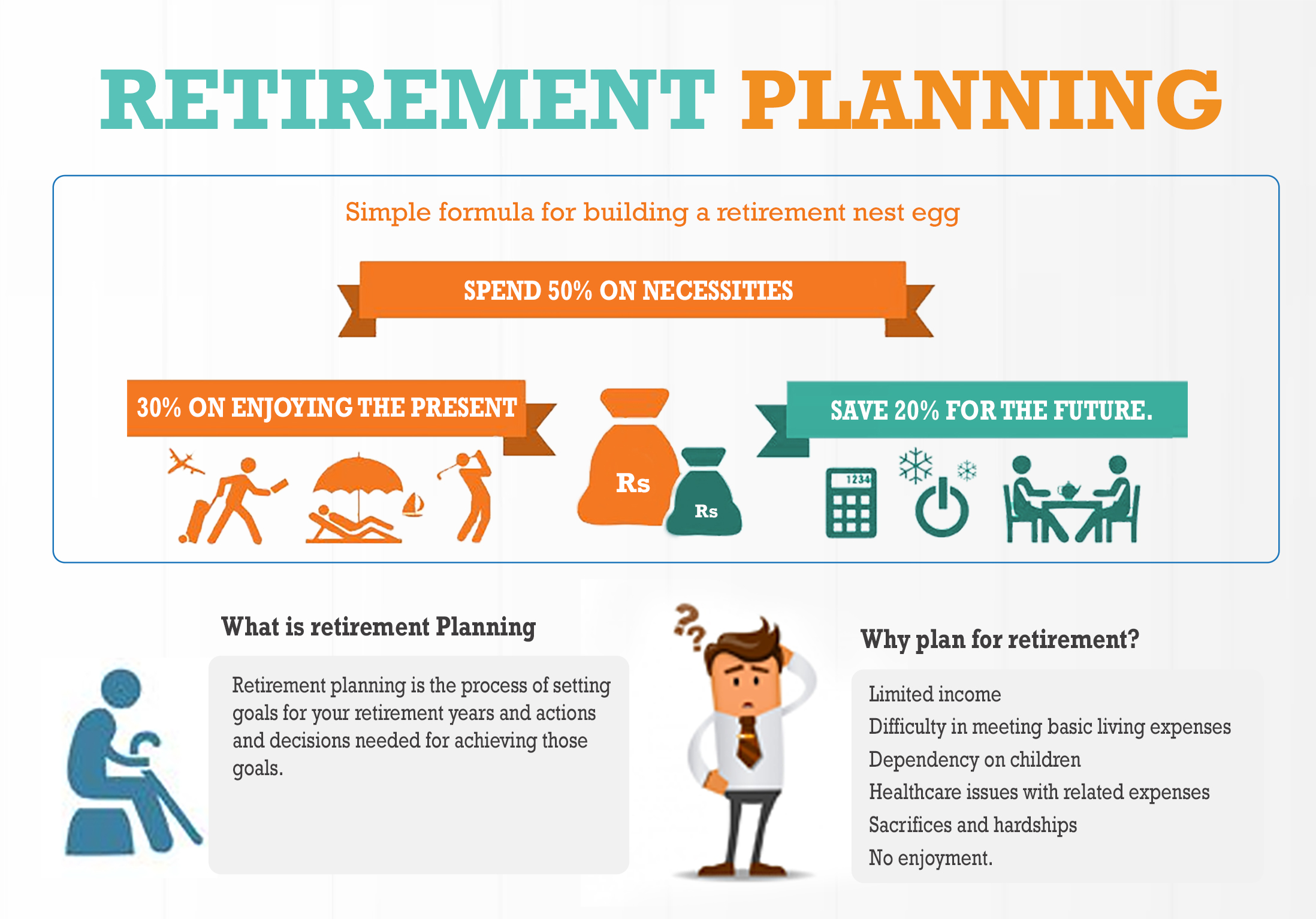

The non-financial facets consist of way of life selections such as exactly how to hang around in retired life, where to live, as well as when to quit functioning completely, amongst various other things. A holistic technique to retired life planning considers all these areas. The emphasis that a person places on retirement planning changes at different stages of life.

Others claim most senior citizens aren't saving anywhere near enough to fulfill those standards as well as should readjust their way of life to survive on what they have. While the amount of cash you'll want to have in your nest egg is essential, it's likewise an excellent suggestion to think about every one of your expenditures.

Rumored Buzz on Wealth Management

As well as given that you'll have more leisure time on your hands, you might also wish to element in the price of enjoyment and travel. While it might be hard to find up with concrete figures, be certain to come up with a practical price quote so there are not a surprises later.

Despite where you are in life, there are numerous essential steps that apply to almost everyone during their retirement preparation. The complying with are some of one of the most common: Think of a plan. This consists of choosing when you intend to start conserving, when you intend to retire, as well as how much you 'd like to save for your ultimate objective.

Check on your investments once in a while as well as make routine adjustments. It's constantly a great idea to make any kind of changes whenever there's a change in your way of living as well as when you get in a various phase in your life. Pension come in lots of sizes and shapes. The policies and also laws for each and every might be various.

You can and need to add more than the quantity that will make the employer suit. Actually, some specialists recommend upward of 10%. For the 2023 tax year, individuals under age 50 can contribute up to $22,500 of their revenues to a 401( k) or 403( b) (up from $20,500 for 2022), some of which might be additionally matched by an employer. wealth management.

An Unbiased View of Wealth Management

The traditional private retired life account (IRA) lets you deposit pre-tax bucks. This means that the money you save is subtracted from your earnings before your tax obligations are taken out. Therefore, it website here reduces your gross income as well as, consequently, your tax obligation responsibility. So if you get on the cusp of a higher tax brace, buying a typical individual retirement account can knock you down to a reduced one.When it comes time to take distributions from the account, you are subject to your common tax price at that time. Keep in mind, though, that the money expands on a tax-deferred basis.

Roth IRAs have some constraints. The payment limitation for either IRA (Roth or traditional) is $6,500 a year, or $7,500 if you are over age 50. Still, a Roth has some revenue restrictions: A solitary filer can contribute the sum total only if they make $129,000 or less every year, since the 2022 tax obligation year, as well as $138,000 in 2023.

All about Wealth Management

The STRAIGHTFORWARD IRA is a retired life account used to workers of local business instead of the 401( k), which is costly to preserve. It functions the same method have a peek at these guys a 401( k) does, permitting workers to conserve cash immediately through payroll deductions with the choice of a company match. This quantity is capped at 3% of an employee's yearly salary.Catch-up contributions of $3,500 enable employees 50 or older to bump that restriction approximately $19,000. Once you established a retirement account, the concern comes to be just how to guide the funds. For those intimidated by the stock exchange, consider spending in an index fund that requires little maintenance, as it simply mirrors a securities market index like the Standard & Poor's 500.

Below are some guidelines for successful retirement preparation at various stages of your check my source life., which is an important and beneficial piece of retirement cost savings.

Even if you can just place aside $50 a month, it will be worth 3 times more if you spend it at age 25 than if you wait to begin spending up until age 45, thanks to the happiness of worsening. You could be able to spend even more cash in the future, yet you'll never ever have the ability to make up for any kind of lost time.

A Biased View of Wealth Management

Nevertheless, it's critical to continue saving at this stage of retired life planning. The combination of making more cash and the time you still have to invest and gain passion makes these years a few of the very best for hostile savings. Individuals at this phase of retirement planning need to proceed to make use of any 401( k) coordinating programs that their companies use.Report this wiki page